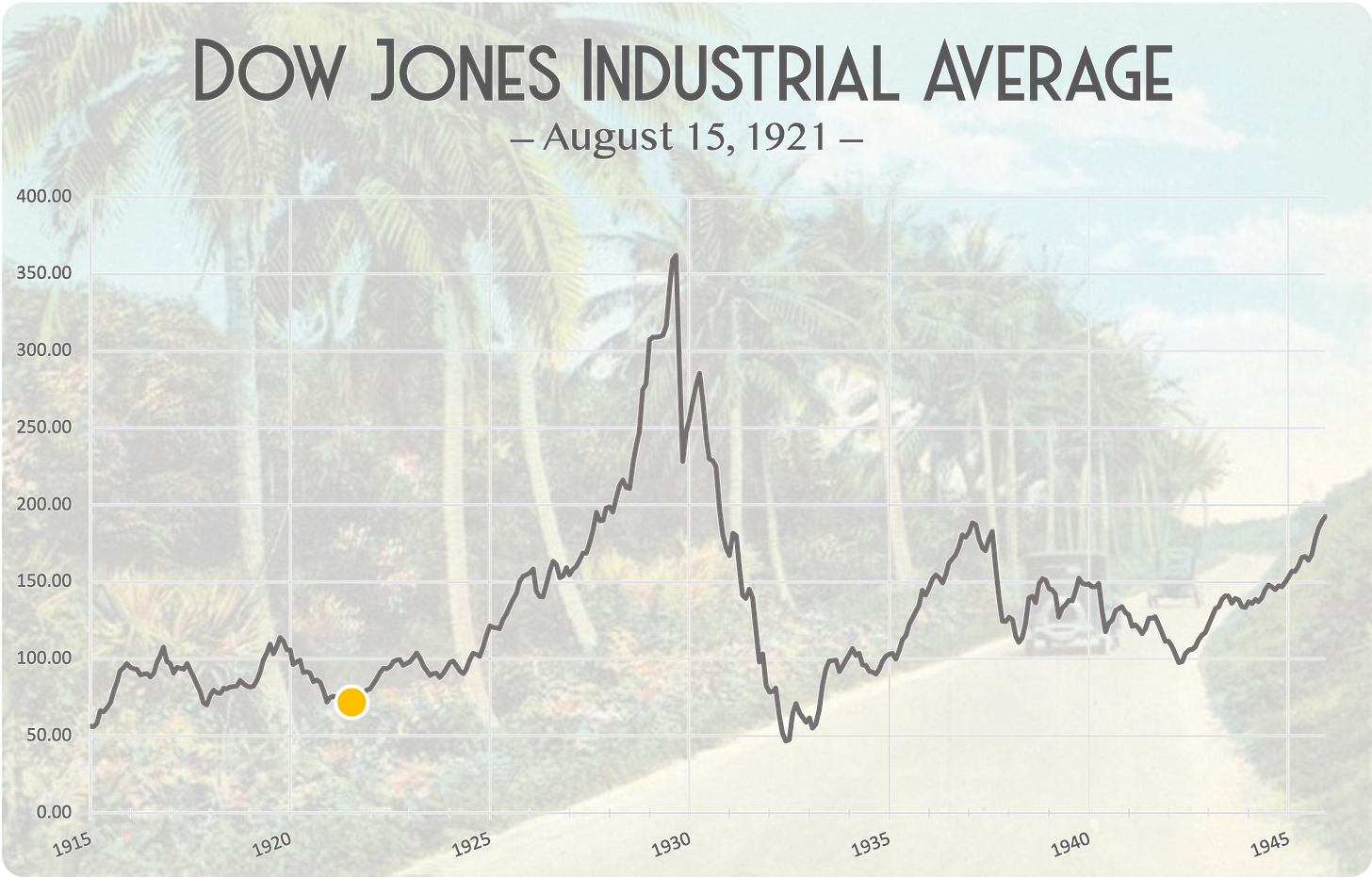

August 15-21, 1921

This week, the summer malaise continues and predictions of a fresh rate cut surface.

Quick Stats:

DJIA: 65.27 (Today: 35,515)

Shiller PE Ratio: 5.2 (Today: 38.8)

Federal Reserve Bank of NY Discount Rate: 5.5% (Today: 0.25%)

GBPUSD: $3.66 (Today: $1.39)

Price of The Wall Street Journal: $0.07 (Today: $4.00)

Market-Moving Themes:

Rate cut rumors (equity, debt markets)

Raw material costs declining after war shortages abate (commodity markets)

German reparations hang over foreign exchange (currency markets)

Executive Summary:

Stocks stubbornly resist positive news. The Dow has settled in the 65-70 range over the past couple months. Despite countless optimistic earnings reports from rubber, railroad, and oil companies, stocks just won’t perk up. A quick report out of Detroit mentions hiring reaching levels not seen since 1919. Another short blurb points to Q1 1921 as the trough in the recession. The deflationary shock appears to be ending.

Historical Fact: It’s easy to play “Monday morning quarterback” and question human behavior 100 years ago. Brokerage accounts went mainstream during 1917 after the US government encouraged Americans to fund the war effort through bond purchases. Government officials and pundits have a powerful, unified message to Americans in 1921: own high quality bonds. This reflects the US Treasury’s desire to balance the budget more than anything else. One legendary investor, Joseph P Kennedy (father of John F Kennedy), fought against this brash consensus and continued investing in equities while at brokerage Hayden Stone.

Renewed talk in banking circles of a 5% discount rate starts to appear in the papers this week. For the past several years, an article explains, the Federal Reserve Bank of New York and the Bank of England have worked in harmony. Typically, it had been the custom of New York to mirror England, however, this changed after Armistice in 1918. The ascendency of America as a net creditor has thrown the preeminent financial capital, London, into question lately.

Historical Fact: Stocks during the 1920-1921 period were cheap by today’s standards (a 5 PE ratio equates to a 20% earnings yield against 5% risk free rates). The Federal Reserve sought to calm post-WWI inflation with major interest rate hikes (the highest until the early 1980s). Today, the Dow sports a 4% earnings yield against a 0% risk free rate.

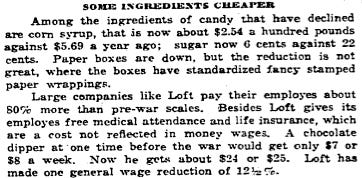

The effects of the 1920-1921 recession propagate throughout the entire economy. High wages remain sticky, but consumer prices and raw material costs are dramatically lower than a year ago. Two candy companies, Miller Brothers and Loft (today known as PepsiCo), reported dramatic price cuts to their products in the latest quarter.

The continued depreciation of the German mark was the outstanding feature of the foreign exchange market this week. There are reports that the Reichsbank’s July 2019 statement shows “massive” increases in paper money circulating. At the end of July 1921, the mark was 135 to $1 and had been fluctuating between 130-140 over the past year. The mark ended this week at 155 to $1 — a swift 10% drop. This massive increase in circulation has led to confusion around reparations and war loan payments. Some think harsh demands from Britain and France are driving Germany towards insolvency.

Reading this newsletter is free. If you enjoy it, then please share to a friend or donate via PayPal (button below). You may also follow us on Twitter.