Quick Stats:

DJIA: 64.98 (Today: 35,456)

Shiller PE Ratio: 5.4 (Today: 39.2)

Federal Reserve Bank of NY Discount Rate: 5.5% (Today: 0.25%)

GBPUSD: $3.69 (Today: $1.38)

Price of The Wall Street Journal: $0.07 (Today: $4.00)

Market-Moving Themes:

Sentiment remains lukewarm towards stocks despite the perfect setup (equity, debt markets)

Raw material prices continue easing as wartime shortages abate (commodity markets)

German reparations hang over foreign exchange (currency markets)

Executive Summary:

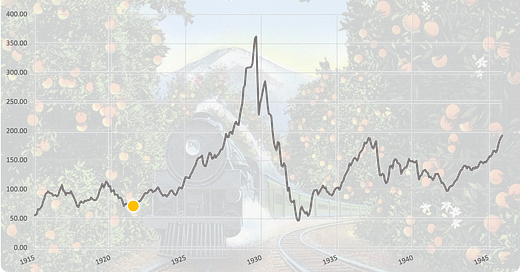

Stocks are finally front page news again. On September 3, 1921, editors for the FT in London gush that there’s a special buzz around stock exchanges in New York (Broad and Wall St) and London (Lombard Street). Some participants are brand new to the market and eager to see what all the hubbub is about. The market low has also provided a fresh opportunity for mainstream news outlets to provide coverage.

The Dow theory of indexing may be brand new but writers mention it could hold the clue for the future direction of the market. If there is a strong bounce from this fresh low, then the current bear might very well be over. Since the Dow hit a fresh low a week ago, new investors have flooded into the market and bears have covered shorts. Volume on Wednesday hit levels not seen since the spring.

Historical Fact: It has been written in the press throughout 1921: stocks have been flat over the past decade so why bother owning them. The Dow averaged about 6% in dividends during the 1910s. $1 in 1911 turned into $1.80 by 1921 — an 80% return that preserved purchasing power. Prior to the Roaring 20s (from 1800 to 1920), stock investors typically purchased for dividends rather than share price appreciation.

Besides the classic stocks and bonds portfolio, another asset class gets mentioned fairly often in 1921: farmland. The FT has a special feature discussing the appreciation of Canadian farmland. From 1870 to 1920, the value of farmland in the Prairie Provinces increased 14x. Over the same period, the stock index (Dow Jones Railroad Index - precursor to the DJIA) returned 15x.

Historical Fact: Today, investors lament broad asset correlation. The truth is, asset classes typically move together over long periods of time and this behavior is not brand new.

Pundits, observers, and investors believe the 1920s will be a slow growth decade. High taxes, heavy regulations, wage pressures are the main culprits. (Author note: the consensus in 1921 was incredibly bearish and incorrectly predicted a slow growth decade; the polar opposite consensus circulates today) This editorial cartoon sums up the mood in 1921:

General Electric offers a new twist on preferred shares. The company authorizes preferred stock at $10/share so retail investors can collect dividends. A front page article in the WSJ mentions that more than 21,500 shareholders are considered retail and thousands of GE employees will soon join the roster. These investors cannot afford to own a set of 10 shares, which is the requirement for receiving dividends. GE’s common shares currently trade for $120 and yield 5%. The new preferred shares will yield 6%.

Reading this newsletter is free. If you enjoy it, then please share to a friend or donate via PayPal (button below). You may also follow us on Twitter.