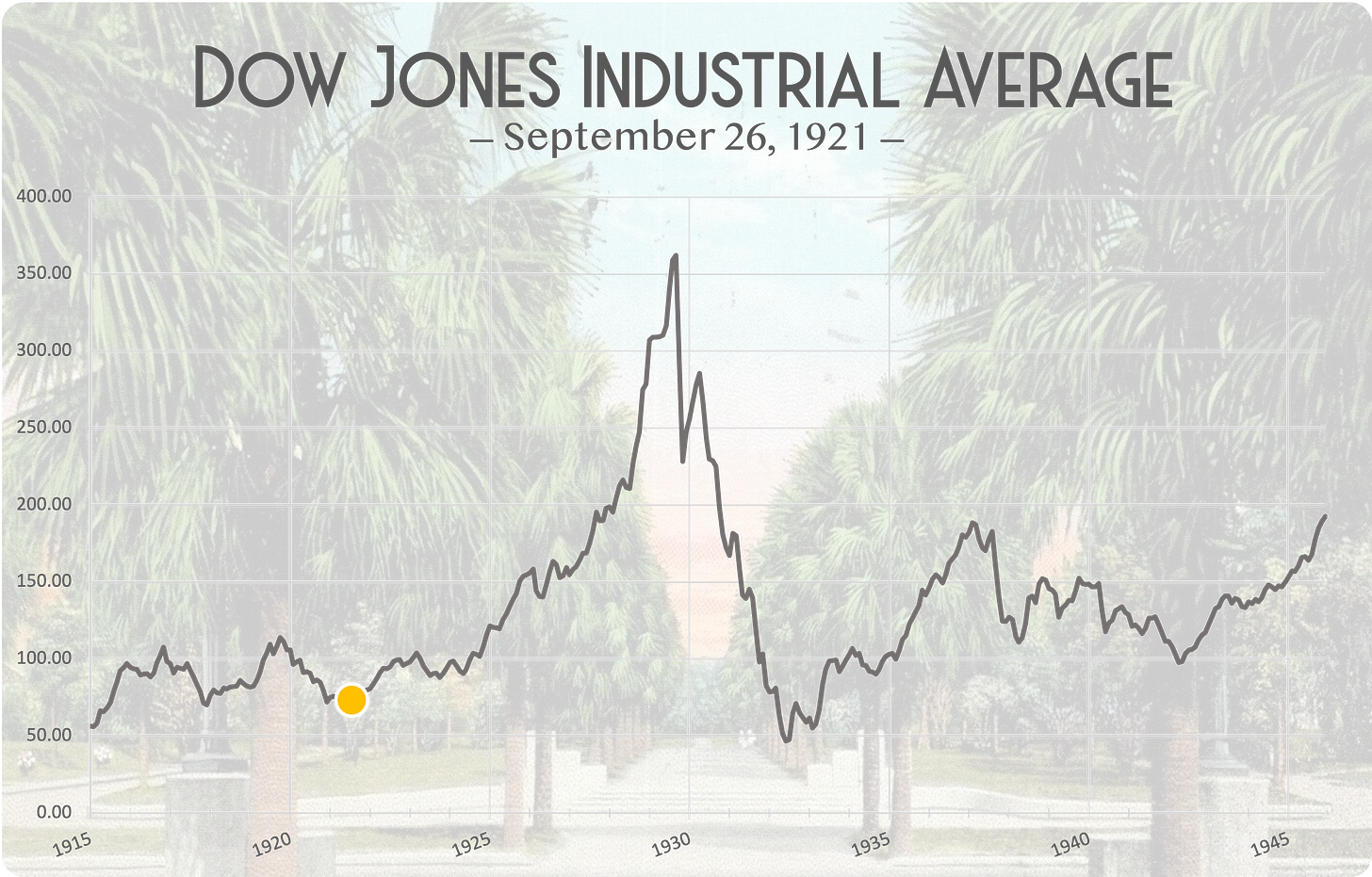

September 26-October 2, 1921

This week, the Dow gyrates aimlessly and the German mark loses 20% of its value as hyperinflation takes hold.

Quick Stats:

DJIA: 70.31 (Today: 34,798)

Shiller PE Ratio: 5.4 (Today: 38.5)

Federal Reserve Bank of NY Discount Rate: 5.0% (Today: 0.25%)

GBPUSD: $3.73 (Today: $1.37)

Price of The Wall Street Journal: $0.07 (Today: $4.00)

Market-Moving Themes:

Sentiment remains lukewarm towards stocks despite improving business conditions and monetary easing (equity, debt markets)

As wartime raw material shortages ease, price stability reigns (commodity markets)

German war reparations causing strong dollar (currency markets)

Executive Summary:

Fall arrives with a whimper. Stocks seesaw between 69-71 throughout the week as traders digest the recent rate cut. One columnist writes how stock investors are a pathetic bunch subject to rumors and emotions. The Fed rate cut hasn’t quelled the nervous nellies. Instead, it’s pushed risk free bonds down further (in 1921, the 10-yr note did not exist, rather WWI-era Victory Notes and Liberty Bonds fulfill this purpose). Some mention the “traders of old” were likely flushed out this year.

On Thursday, a great article in the WSJ about a relatively new method called “Dow’s theory of indexing” walks readers through the stock market low from one month ago. The writers discuss how the most recent low on the Dow was 60, set in 1915. Because stocks met resistance last month despite awful sentiment, a bottom formed.

Between November 1919 to September 1921, the German mark collapses from 12 to 150, and the “flight of the mark”, as it is being called, leads to the Berlin stock exchange closing several days each week as Germans inundate the exchange by buying any and all equities - preferably international ones - up to their personal limit. Official government reports dismiss fears of money printing as rumors from British and French financiers. German equities surge about 20% by Friday, keeping pace with the currency devaluation.

Historical Fact: The magnitude of German inflation is hard to comprehend to the modern reader, but it will get much worse in the next 24 months. A more recent example has been the troubles out of Turkey. In both cases, a vast majority of 1920s Germans and 2010s Turks did not own much domestic currency. Instead, marks and liras were quickly converted to assets like domestic and international equities, foodstuffs and real estate.

The editors at the WSJ gather notes from prominent businessmen about German conditions. Americans and Europeans have been vacationing in the country. The ultra cheap mark means dollars and pounds go further - almost unrealistically further. A New York businessman describes how a haircut cost him less than a penny in Berlin (one-third of New York or London prices). Insulting a New Yorker’s rakish charm is his biggest worry, so tipping generously is warranted.

Price drops here. Price drops there. 1921 has seen major deflation in commodity prices as post-war shortages lead to gluts. Among them is rubber. One of the largest tire makers, Dunlop (today owned by Goodyear), has passed cheaper input costs onto consumers in the form of lower prices. A short feature in the FT on October 1 discusses rubber prices and it concludes that prices will moderate in the coming years and help end the ongoing recession.

Historical Fact: Nearly all commodity price shocks from post-war shortages end by mid-1921. Rubber, oil, sugar, cotton, corn, and soybeans. The list goes on. Throughout the 1920s, commodity price stability will help fuel the economic boom, similar to the 1990s.

Reading this newsletter is free. If you enjoy it, then please share to a friend or donate via PayPal (button below). You may also follow us on Twitter.